GST rules on beverages can drive retailers to drink

By Erin Maher, KPMG

Business Operations Beverages alcohol tax

Food manufacturers are creating clever new beverages, mixing ingredients to create non-traditional products such as flavoured soy, flavoured water, and carbonated iced tea. But when these characteristics are mixed, the sales tax results can seem inconsistent, making it tough for retailers to tell when they have to charge tax.

The complexity of the GST rules on beverages can create risk for retailers. If audited, a retailer may be assessed for any GST that is not accurately charged on taxable products, which may not be recoverable from customers.

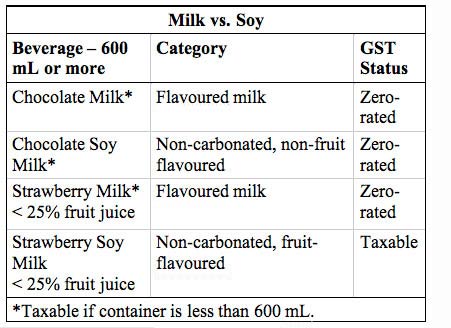

Generally, beverages are taxable when they are carbonated, alcoholic or, if fruit-flavoured, contain less than 25 per cent natural fruit juice. Beverages are also generally taxable when sold in containers of less than 600 mL.

Let’s see how these rules apply in practice by comparing family-sized traditional versus non-traditional beverages.

Why is strawberry-flavoured soy milk treated differently than strawberry-flavoured dairy milk or chocolate soy milk for that matter? The rules for milk apply only to dairy milk and not alternatives like soy or rice milk. Further, if the non-dairy, non-carbonated beverage is fruit-flavoured, it must generally contain at least 25 per cent natural fruit juice or else it is taxable. Therefore, strawberry-flavoured soy milk will be treated differently than the same soy beverage with chocolate flavouring.

Let’s look at another example.

Non-carbonated iced tea products, prepackaged in multiples or family-sized, are not subject to the same rules as other fruit-flavoured beverages and are zero-rated, regardless of flavouring. Flavoured water, however, is subject to the 25 per cent juice rule and is taxable regardless of the volume. Further, carbonated iced tea is always taxable, as it loses its characterization as a tea and follows the carbonated beverage rules.

To add to the confusion, provincial retail sales taxes can also apply. For example, Quebec and Manitoba follow the GST rules but Ontario does not.

To reduce the risk of an assessment for under-remitted sales tax, retailers should have an appropriate system in place to ensure that the correct amount of sales tax is charged on sales of their products.

Print this page