Navigating price volatility in the meat sector – new feature story by Kyle Burak, FCC

Food in Canada Staff

Food In Canada Meat &Poultry Farm Credit Canada meat price Trends volatilityThe meat processing sector has experienced its fair share of ups-and-downs over the past couple of years, notes Kyle Burak, Senior Agricultural Economist at Farm Credit Canada (FCC), in our latest issue.

Global supply reductions have expanded export opportunities while rising incomes supported domestic demand in 2019. The COVID-19 pandemic shifted consumption away from foodservices, created new opportunities in retail sales and increased processor’s costs. Plant-based proteins have increased competition — however, they still represent a small proportion of overall protein demand.

Sales increasing on strong export demand

Over half of Canadian beef and 70 per cent of pork is shipped internationally, making exports key for growth. Exports have grown at an average rate of 5.8 per cent between 2015-19, with sales growth averaging 2.7 per cent. Plant shutdowns in 2020 resulted in sales falling 11.8 per cent in April YoY, introducing a significant backlog in livestock. FCC’s October Red Meat Outlook projected livestock prices to remain below the five-year average into 2021. Export opportunities to China, the U.S. and Vietnam have driven the recovery. Add this up, and exports are up 9.2 per cent YTD, with sales up 2.6 per cent through September.

Sales are forecast to decrease by 0.4 per cent YoY during the fourth quarter as the second wave of COVID impacts the global foodservice industry, bringing the annual growth rate to 1.8 per cent (Figure 1). The impact of COVID will continue to be felt into 2021 as well. We project sales to decrease by 0.6 per cent for the year, largely due to the abnormally strong Q1 in 2020 and continuing struggles in foodservice. The remainder of 2021 should see more stable growth as the impacts of COVID wane.

These forecasts embed lots of uncertainty given the risks to the economy, global trade, and livestock prices related to the COVID-19 pandemic. According to the USDA FAS, Canadian beef and veal exports are predicted to increase by 4.0 per cent, and imports decline by 8.3 per cent in 2021. This could tighten the domestic beef supply and lead to increases in beef consumer prices. This should benefit the demand for chicken and pork. Pork exports are expected to decline by 2.0 per cent, and imports remain flat due to an increasingly competitive global export market.

Domestic meat demand sensitive to price

Lower incomes, foodservice closures, processing plant shutdowns and inflation in beef and pork (peaking at 21.6 per cent and 8.4 per cent in June YoY) caused a decline in consumption this year. This inflation is now behind us, but many Canadian households are still dealing with tighter budgets that could have longer-term impacts on the industry.

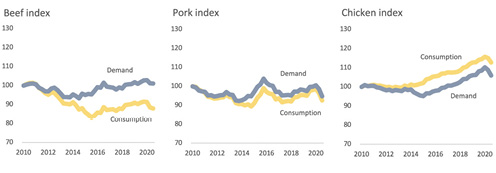

Beef and pork prices have increased by 68.2 per cent and 40.1 per cent, compared to 26.8 per cent in chicken over the past 10 years. This price discrepancy has had significant impacts on consumption trends. Beef demand is strong, but higher prices can lead to a slower beef consumption trend (Figure 2). Chicken, on the other hand, benefits from subdued retail price pressures. Domestic red meat consumption growth will continue to be hindered by higher prices unless incomes grow proportionally higher.

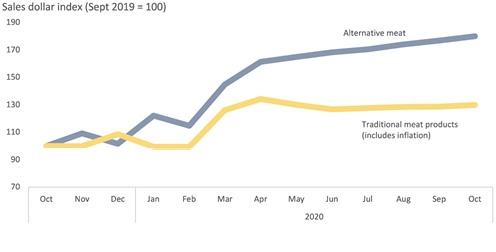

Growth in plant-based protein to-date has been in alternative beef, but as the cost of production lowers, companies have begun to expand their offering and become more of a presence. FCC estimates the Canadian grocery market share of alternative protein vs. traditional sits at roughly 2.9 per cent, up from 2.0 per cent pre-pandemic in January. Kearney projects the global market share could reach 10 per cent by 2025 and 25 per cent by 2040. With demand for meat accelerating more rapidly overseas, exporting to Asia and Europe could become more important as alternatives gain steam domestically.

Pork export growth to China not sustainable

Pork exports to China are over 187 per cent higher than 2019 through September 2020 as China’s production continues to be hit by ASF. China could continue to provide short-term opportunities, but as China rebuilds its herd, Canadian businesses must also look elsewhere for growth. Preferred partners Mexico, Japan and the U.S. are all expected to increase pork imports, and large importing EU nations under CETA could provide opportunities for diversification. Although non-tariff trade barriers hinder EU trade, Germany’s struggle with ASF could provide openings.

The case for automation grows

COVID-related wage bumps and safety protocols increase costs, and so the case for automation grows. But 2020 was no abnormality in terms of labour costs growth either. The industry added 13,435 jobs since 2015, while keeping compensation per hour relatively stable. Employment growth did not lead to productivity gains as productivity dropped 15.8 per cent between 2015 and 2019.

Full economic recovery continues to be slow

The second wave of the COVID-19 pandemic has proved larger than the first, and with economic momentum dwindling, a full economic recovery is not likely until 2022. The Bank of Canada predicts that the Canadian GDP will shrink by 5.7 per cent in 2020 and increase by 4.2 per cent in 2021. Expect the recovery in foodservice, particularly full-service restaurants serving higher grade meats, to follow a similar trajectory.

The meat processing industry has proved resilient and adaptable during the pandemic on the back of strong demand despite spikes in consumer prices. The pandemic also highlighted the need for investments and innovation to sustain profitability in response to labour challenges, rising meat alternatives and global competition.

Print this page