Workforce challenges and COVID-19 impacts

By Jennifer Griffith

Business Operations Processing COVID-19 Editor pick Food Processing Skills Canada labour shortageThe numbers tell the story

Photo © YuanGeng / Adobe Stock

Photo © YuanGeng / Adobe Stock Earlier this Spring, Food Processing Skills Canada (FPSC) released the industry’s latest labour market information report, At the Crossroad to Greatness – Key Insights & Labour Market Research About Canada’s Food and Beverage Processing Industry.

This report brings together analysis we have conducted with industry surveys, data collection and previous labour market research on generational perspectives and engagement of underrepresented groups.

As with most analyses, there is both confirmation of what leaders expected and also new insights. The report offers a 360-degree view of the industry across a range of issues and provides the latest information on industry profiles, trends and key workforce-limiting factors. We also looked at the impacts of COVID-19 on production and revenue. Despite the challenges of the last year, the report is optimistic—global demand for food continues to rise and consumer preferences are driving new products. That said, solving the employment challenge is the number one priority. Consider these two workforce scenarios:

1) “the baseline scenario” is where export growth is tied to a United Nations forecast of world population growth; and

2) “the growth scenario” is an alternative one where the Agri-Food Table’s $85 billion export target is met by 2025.

The hiring requirement for the industry over the 2020-2025 period in the “the baseline scenario” is estimated at about 32,000 (or 11 per cent of the industry’s workforce in 2020).

In “the growth scenario,” the hiring requirement rises to 56,000, equivalent to 20 per cent of the industry’s 2020 workforce. This is an additional 24,000 workers to the baseline forecast.

If those figures aren’t startling enough, the research reveals the industry is starting from a deficit today with existing critical labour shortages.

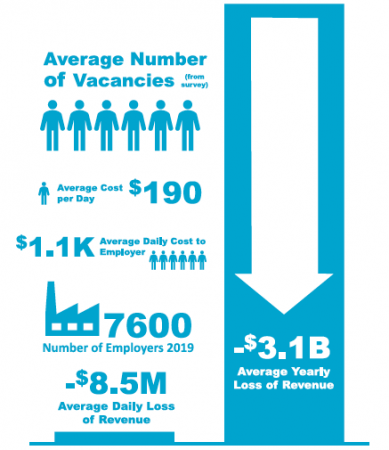

The analysis has also estimated a single unfilled position in the food and beverage processing industry could cost businesses as much as $190 per day in lost net revenue. That may not seem like much, but when you aggregate it over the entire sector, losses from job vacancies could total up to an estimated $8.5 million in net revenue per day. If this is not addressed, the $8.5 million per day becomes $3.1 billion annually.

Findings from a recent labour market report by Food Processing Skills Canada. Image courtesy FPSC

These figures underscore this is not a human resources issue alone; it’s actually the most critical business challenge for the sector. As this report illustrates, labour availability is the top overall business challenge, ahead of coping with regulations, implementing technology and meeting customer preferences. A few key highlights from the report follow below.

Workforce demographics

Approximately 31 per cent of the industry’s workforce consists of immigrants, compared to only 23 per cent of the overall labour force.

There is a higher proportion of men than women working in management positions, and as tradespeople or transport and equipment operators.

Women make up a larger share of business, finance and administration positions, and sales and service occupations. Further, more than half of the sector’s workforce continues to be made up of labourers.

HR strategy

The biggest challenge for employers is accessing a pool of qualified candidates with skills training identified as the second largest challenge.

Traditional benefits (e.g. standard health and dental coverage, personal performance bonuses and free parking onsite) continue to hold broad appeal across generations.

Health and wellness programs (e.g. availability of free fresh foods, healthy drinks and snacks and comfortable and well-equipped lunch and break rooms) are very attractive to young people and women employees.

Recent immigrants, Indigenous People, youth, and those with recent experiences of unemployment are more receptive to careers in the industry, and recruitment efforts should be targeted to appeal to these groups in your area.

Education and skills training

The vast diversity of industry occupations is reflected in Canada’s educational landscape with approximately 490 industry relevant programs of study offered by 160 institutions.

Almost all companies use at least some form of training in the workplace, although only one-third have a defined annual training budget.

A deficit in training options has been identified for industry production workers, and a disconnect is apparent between training programs available for the industry and the level of employer awareness of those classes.

What we have learned from this report is that, as an industry, we must do a better job of raising awareness of the sector and the jobs available, and making improvements to human resource strategies that build workforce skills through a long-term strategy. Streamlining immigration programs to attract new individuals and workers is also essential.

The report concludes with a number of recommendations on solving immediate employment gaps and supporting long-term workforce development strategies. It is important to highlight that these recommendations aren’t quick fixes but solutions that demand teamwork between industry leaders, educators and governments.

To download the At the Crossroad to Greatness – Key Insights & Labour Market Research About Canada’s Food and Beverage Processing Industry, please visit www.fpsc-ctac.com.

Jennefer Griffith is an executive director at Food Processing Skills Canada.

This article was originally published in the May 2021 issue of Food in Canada.

Print this page